The US grocery industry is big business, the total market estimated as being worth $758.5bn in total sales 2021. Market experts estimate that on an average day, 32 million Americans head to a supermarket or grocery store.

In this series, Checkpoint aims to dig a bit deeper into the grocery market in the US. We’ll be delving into detail on the impacts of shoplifting on grocery retailers, attitudes toward theft and the products being targeted, and options available to grocers to reduce losses incurred.

As a company, Checkpoint believes that technology is crucial in the fight against shoplifting, so we’ll also explore what technology can help and how it can be applied.

Super sales at supermarkets

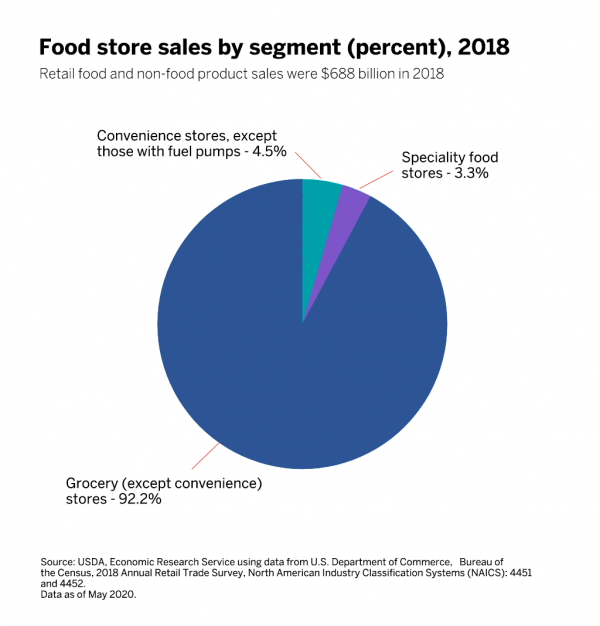

Grocery sales in the US is big business. According to the USDA, the US Grocery Market had revenues of over $688 billion in 2018 from its huge population of over 115,857 grocery retailers[1]. Stores range from some of the largest retailers in the US, to countless local “mom and pop” stores that exist all over the US.

An incredible 92.2% of all spending in the US on food and drink occurs in what are categorized as grocery stores (supermarkets and smaller independent grocers). Convenience stores make up the next highest proportion, a mere 4.5%. The remaining 3.3% is spent in specialized food stores, including markets, butchers, bakeries, candy shops etc[2].

The big players dominate the US grocery field

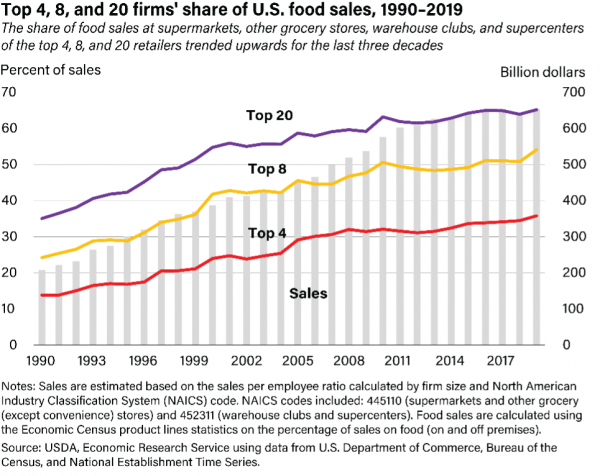

Of these grocery stores, over 40,000 are classified as supermarkets[3] and these represent the bulk of the business being generated. This market is dominated by the top four operators, Walmart, Kroger, Albertsons, and Target, with these companies’ sales growing steadily since 1990 to a position of being jointly responsible for approximately $350 billion sales in 2019[4].

The top-heavy nature of the grocery market is continued when we look at the top eight and top 20 supermarket banners in the US. The top eight take over 50% of the market and generated some $540 billion together in 2019, while the top 20 take over 60% of the total market[5].

Large grocery sellers overcoming COVID

The worldwide COVID 19 pandemic has hugely impacted many retail sectors, but globally the grocery sector has been very resilient, and in many cases has experienced considerable sales growth during this troublesome period.

The impact of the popularity of online/home delivery is likely to drive retailers’ expansion into this area and grow revenues further, but operating costs for this type of service tend to be higher than those associated with a bricks and mortar store profile. This is down to costly distribution operations with a higher cost base. Because of this, there remains a place for physical stores especially within the fresh food sector.

Big challenges, small margins

However, new challenges are always appearing, with today’s consumer more interested and aware of sustainability and environmental issues like reduction in single use plastics and other green issues. Coupled with the influx and expansion of overseas low-cost competition from the likes of Aldi and Lidl, there are always challenges ahead for the established leaders and the focus on profitability will be even more paramount.

While revenues are high and continue to grow, grocery retailing is still fundamentally a low-margin business. Dependent on format and local competitive issues, earnings before interest, taxes, and amortization (EBITA) margins range from 4-8% and EBIT (earnings before interest and tax) runs between 2-5% of net sales. Returns on capital employed ranges from 7-12%.

The key attractiveness of the grocery retail business continues to be as a cash generating profit business.

But how long will this last as the industry continues to be squeezed from all sides? Are these margins sustainable post-pandemic? And how can smaller, independent grocers compete with the bigger, national players who have so much more capital on hand in the first place?

Next time…

This article is the first in a 10-part series that looks at the grocery industry in the US in detail and evaluates how a technology like electronic article surveillance (EAS) can help the businesses operating in this market to future-proof their business.

Next time we look at the impact of theft on US grocery retailers.

References

[1] USDA, Retail Trends, 2019

[2] USDA, Retail Trends, 2019

[3] IBIS World, Supermarkets & Grocery Stores in the US, July 2021

[4] USDA, Retail Trends, 2019

[5] USDA, Retail Trends, 2019