The US grocery industry is big business, the total market estimated as being worth $758.5bn in total sales 2021. Market experts estimate that on an average day, 32 million Americans head to a supermarket or grocery store.

In this series, Checkpoint aims to dig a bit deeper into the grocery market in the US. We’ll be delving into detail on the impacts of shoplifting on grocery retailers, attitudes toward theft and the products being targeted, and options available to grocers to reduce losses incurred.

As a company, Checkpoint believes that technology is crucial in the fight against shoplifting, so we’ll also explore what technology can help and how it can be applied.

In our first instalment, we outlined the current state of the grocery industry as a whole and considered some of the challenges facing the sector as we come out the other side of the pandemic. This time, we want to focus on the economic impact that customer theft has on retailers.

Recording shrink

Although shrink is recorded in different ways and allocated to differing root-causes by different retailers, generally accepted industry reports run over a substantial period. A 2018 National Retail Security Survey found that the average retailer in the US has a shrink of 1.33%. However, for one in four, it is 2% or higher[1]. Using these figures, shrink costs the US retail industry almost $50bn each year.

The previous years’ investigation[2] calculated that approximately 37.5% of total shrink comes from customer theft. Incredibly, 33.5% comes from employee theft, highlighting the prevalence of the insider threat for retailers.

It’s clear that shoplifting is a huge problem in the US. Using the figures above, we can estimate that US retailers lose around $15-$20bn each year to customer theft, and not a lot less to employee theft. Add into that natural losses from food spoilage and breakages or issues with the packaging of food, and a US grocery retailer may be seeing narrow profit margins disappear entirely. Because when you lose more, you sell less.

Worryingly for retailers, more recent data indicates that shoplifting has increased in the US due to the COVID-19 pandemic and subsequent economic pressures felt by certain citizens[3]. Chances are that the numbers above are even worse for retailers in 2021.

Putting shrink into context

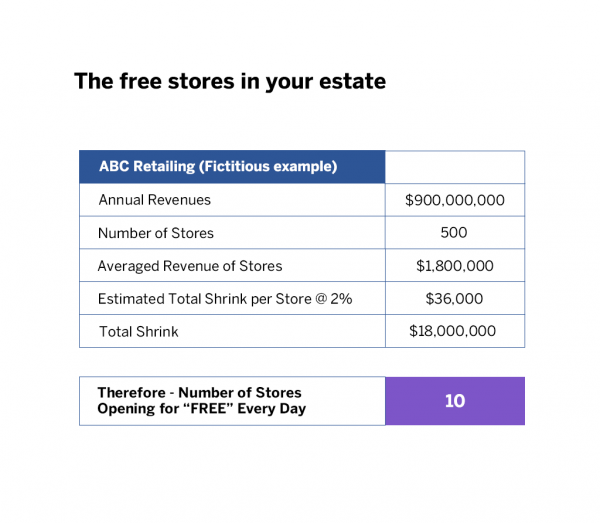

There is no doubt that is a huge number but sometimes it can be difficult to put into context. Can we potentially illustrate this in a different way? A loss of 2% from all stores in the chain for example could be considered by some as the price of doing business in today’s world, but what does that look like when viewed in a different way?

Looked at this way, the effect of shrink is to say that this organisation is running 10 stores, 24 hours a day, all year, just for the convenience of thieves, with the cost of the land, store build, fit out costs, staffing and products, all for free. Most rational businesses would rightly view this as an untenable situation.

So rather than expanding the chain by building another 20 new stores to increase revenues and profitability, is it not better to reduce the chain wide shrinkage overall and make the 10 “free” stores become profitable? A realistic goal of halving the shrink number would return five stores to profitability could be achieved, as it is unlikely that shrinkage will be eliminated completely.

Although this is a simplistic illustration, it does put into perspective the issue. No one would accept 10 stores being robbed of all product year in and year out, would they?

High-theft items

Within grocery the items with the highest shrink were recorded as within the beers, wines and spirits category (most EU supermarkets operate their own BWS sections and have liquor licenses for most stores), followed by meat and cheese, cosmetics and confectionary items.

High-value items such as Champagne has always featured in the lists of most stolen items, but the increase in the theft of expensive meat cuts and other fresh produce continues to rise. Most notably this is the case for cheese, which many believe to be the most stolen item in the world, with estimates indicating an incredible 4% of all cheese produced ending up stolen[4].

All retailers will have a hot list of 20 to 50 most stolen items and these most stolen lines amount for a disproportionately large proportion of total losses. Focusing on the top 20 of these is likely to have a favorable effect on total losses in a quicker time than trying to blanket protect whole groups or lines of merchandise. It is also easier to control and measure the impact of loss prevention technology pilots by focusing on a smaller key selection of problem items. Much of the pilot work carried out by Checkpoint has focused on key products and control stores. It has not been uncommon to see 50% reductions in loss on these hot items during properly managed EAS pilots.

High shrink items are, by their nature, desirable in some form, so the balance of open merchandising versus locking them away from casual theft has been a difficult one to achieve. Studies have shown that both sales and theft increase when products are on open, accessible display. Careful placement within the store can help deter theft but protecting the products themselves with overt tagging can enable retailers to openly display items while protecting them at the same time.

Next time…

…we look at the potential ROI of an Electronic Article Surveillance solution. While it is one thing to identify that shrink is an issue, retailers will want to know how much they can save from protecting products with EAS. Deploying EAS in-store is a case of spending money to save money. So how much can a retailer expect to save? And how long after deploying can they expect a positive ROI? Find out next time.

References:

[1] NRF, National Retail Security Survey, 2018*

[2] NRF, National Retail Security Survey, 2017

[3] Washington Post, Stealing to survive: More Americans are shoplifting food as aid runs out during the pandemic, Dec 2020

[4] Eat This, Not That, This Is the Most Commonly Stolen Food In the World, Data Says

*NRSS data is released three years after the fact, so the 2018 data is the latest as of 2021